Private vs SOEs

Private enterprises and SOEs have been competing in different areas during the global boom, Xia said.

State-owned enterprises usually outdo private businesses on big projects and are better in supportive areas. Private enterprises excel in chasing short-term profits and take different risks, he said.

"A real headache is that their offers in many projects are really low, but the risks are very high, and their risk resistance is weak. In some less-developed markets, private businesses are somewhat of a spoiler," Xia said.

Wei Jianguo, vice-chairman of the China Center of International Economic Exchanges and a guest economist of China Daily, said that "now is the best time for China's private enterprises to go abroad for overseas investment".

During the nation's highest-level economic meeting, the Central Economic Work Conference that was held from Dec 10 to 13, China vowed to enhance guidance and services for going global, provide necessary data and streamline the procedures for outward investment.

As the government shifts approvals toward a management mechanism of supervision and services, outward direct investment by individuals will see a rapid increase, said Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a think tank of the Ministry of Commerce.

Ge Min, a deputy director at the All-China Federation of Industry and Commerce, said that private enterprises, which account for half of China's total investors abroad, will accelerate their overseas spending.

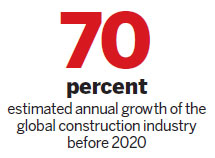

From January to November, Chinese companies achieved an accumulated realized turnover on project contracting of $109.69 billion, up 7.1 percent from a year earlier, and the value of newly signed contracts was $143.07 billion, up 11.1 percent year-on-year, according to the ministry.

In the same period, non-financial outward investment rose 28.3 percent year-on-year to $80.24 billion, according to the ministry.

Special Coverage