|

|

CAI MENG/CHINA DAILY |

US politicians invariably bemoan trade as the enemy of the middle class, the major source of pressure on jobs and wages. The current presidential campaign is no exception: Republicans and Democrats alike have taken aim at both China and the Trans-Pacific Partnership Agreement, holding them up as the scourge of beleaguered US workers. While this explanation may be politically expedient, the truth lies elsewhere.

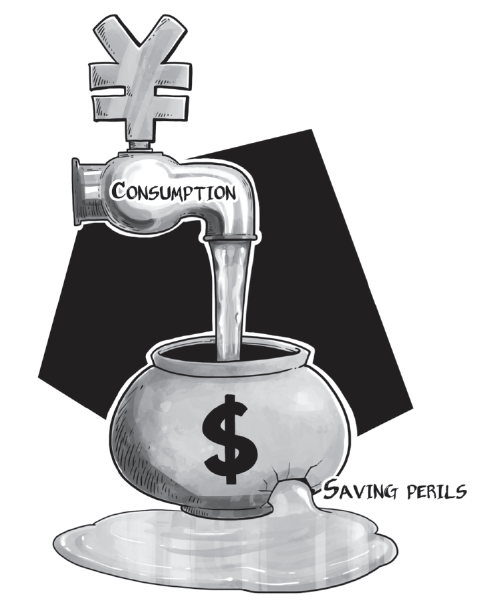

When it comes to trade, as I recently argued, the United States has made its own bed. The culprit is a large saving deficit, the country has been living beyond its means for decades and drawing freely on surplus saving from abroad to fund the greatest consumption binge in history. Politicians, of course, don't want to blame voters for their profligacy; it is much easier to point the finger at others.

The saving critique merits further analysis. The data show that countries with saving deficits tend to run trade deficits, while those with saving surpluses tend to run trade surpluses. The US is the most obvious example, with a net national saving rate of 2.6 percent in late 2015-less than half the 6.3 percent average in the final three decades of the twentieth century-and trade deficits with 101 countries.

The pattern also holds true elsewhere. The United Kingdom, Canada, Finland, France, Greece, and Portugal-all of which have large trade deficits-save much less than other developed countries. Conversely, high savers like Germany, Japan, the Netherlands, Norway, Denmark, the Republic of Korea, Sweden, and Switzerland all run trade surpluses.

Saving imbalances can also lead to destabilizing international capital flows, asset bubbles, and financial crises. That was the case in the run-up to the financial crisis of 2008/2009, when global saving imbalances, as measured by the disparities between countries with current-account deficits and surpluses, hit a modern record. The asset and credit bubbles fueled by those imbalances brought the world to the brink of an abyss not seen since the 1930s.

Here, too, there is considerable finger pointing. Deficit countries tend to blame the yield-seeking "saving glut" that sloshes around in world financial markets. As former US Federal Reserve Chairman Ben Bernanke put it, if only countries like China had spent more, the bubbles that nearly broke the US would not have formed in the first place. Others have been quick to point out that the US' supposed growth miracle probably could not have happened without the capital provided by surplus countries.

The prudent approach would be to strike a better balance between saving and spending. That is particularly important for the US and China, which together account for a disproportionate share of the world's saving disparities. Simply put, the US needs to save more and consume less, while China needs to save less and consume more. To succeed, both countries will have to overcome entrenched mindsets.

On this front, China has been leading the way, with a strategy of consumer-led rebalancing that it introduced five years ago. The results so far have been mixed, as inadequate funding of a social safety net continues to temper the support to household incomes provided by services-driven job creation and urbanization-led increases in real wages. But China has lately shown a commitment to addressing this shortcoming. Its recently enacted 13th Five-Year Plan (2016-20) aims to dampen fear-driven precautionary saving through interest-rate liberalization, the introduction of deposit insurance, the loosening of the hukou residential permit system (which would improve benefit portability), and relaxation of the one-child family planning policy.